Goodbye 2021. A year of great anticipation, January 2021 was filled with goodbyes to 2020 and turning our focus to a year of recovery. And recover we did! Segments of the economy re-opened, the S&P 500 registered 68 record highs and by March job openings increased 80% over the prior year, according to FRED US Bureau Labor and Statistics. Yet even with all of that progress, sitting here in January 2022 we face many new challenges that require more thoughtful solutions.

A Hard Look at the Labor Force Today

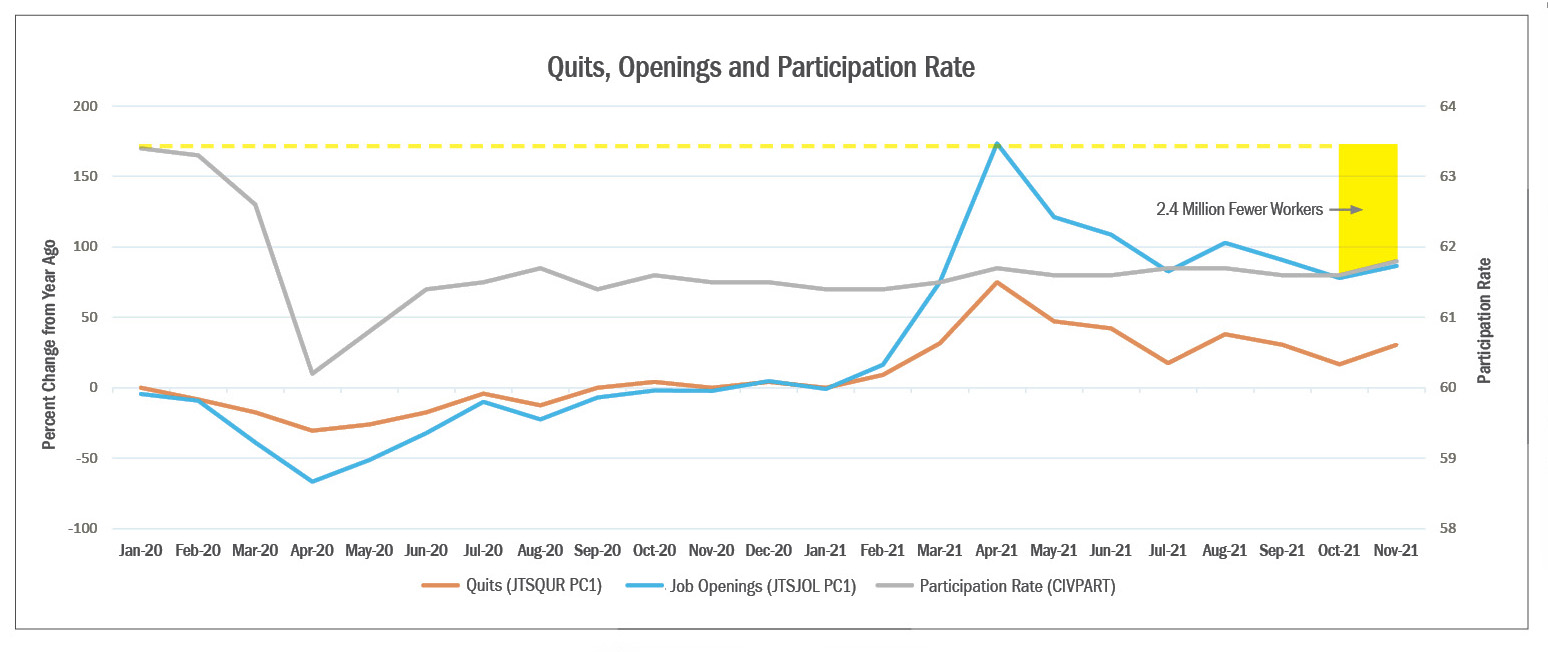

Our greatest challenge is one we all face, a new labor dynamic constricting growth across industry supply chains. This year we learned terms like “The Great Resignation” and saw employment models like gig workers’ spike in popularity. The result is an empowered workforce that has been able to capture more compensation working in more flexible virtual environments. According to Q4 2021 US Bureau of Labor and Statistics data, April 2021 registered twice as many job “quits” as April 2020, and employee compensation was 15% higher than the prior year. However, over the subsequent eight months employees struggled to outpace an inflationary environment, actually losing buying power as CPI increased three percentage points while employee compensation year-over-year is off five points.

Ultimately these statistics will stabilize as the labor supply and demand curve settles, but the Labor Force Participation Rate (LFPR) points to a potentially significant longer-term implication on labor supply. Heading into the COVID-19 shutdown of April 2020, the LFPR was north of 63% before dropping to 60% and only recovering to and remaining steady at 61.5% (61.8% in November 2021). If participation rate fully rebounded, 2.4 million workers would be added to the workforce. However, the total pool of participants is shrinking as well, due to large shares of retirement, some pandemic induced, and workforce exits. December 2021’s payroll numbers showed 400,000 new jobs with an unemployment rate dropping to near 4%, but when we talk about the new normal, a workforce with millions fewer workers at full employment requires us to think differently.

Turnover and Outsourcing: More New Normals?

In September 2021 we wrote about the tightening labor market, looking at three tactical ways to help a business become less dependent on recruiting, developing and retaining non-core employees. Our follow-up piece in October explored technologies that are helping eliminate manual data entry, accounting and reporting processes. Now, turning the page to 2022 and facing (yet another) new normal, businesses are accelerating investments in these technologies and the corresponding opportunity to outsource supporting business processes in a different way than before.

McKinsey Quarterly highlights the labor challenge facing business leaders, noting from a recent study in their “Great Attrition” article that 40% of employees are somewhat likely to leave their current job in the next three to six months. In that survey, 18% of workers say they are “likely to certain” they will change jobs over that time period. This turnover can be very disruptive and costly to businesses. The day-to-day investment of time required to source, recruit, interview, onboard and develop employees is significant, especially when nearly one in five employees is likely to turn over every three to six months.

Looking deeper at finance and accounting (F&A) jobs, these roles are becoming more compelling candidates to outsource. CFOs as stewards of the business require scalable, credentialled resourcing models that can reliably deliver real-time analytics and trusted monthly financial and management reporting. This information is critical for business leaders to make informed revenue and operational decisions, and the new technologies help outside parties deliver more efficient data management processes across internal and external data sources. The result is better reporting with a lower related cost to deliver.

For example, the American Productivity & Quality Center benchmarks cite average F&A personnel costs at 1.4% of revenue, with best-in-class businesses operating at the 0.6 to 0.7% range. Within specific process areas like managing collections, these benchmarks present an even greater cost reduction opportunity with average performance at $0.92/$1,000 revenue and best-in-class down at $0.20/$1,000 revenue. For a $1 billion revenue company, this can equal over $700,000/year in cost savings. Couple that with HR’s backlog of core jobs that need filled, and outsourced F&A jobs become even more valuable.

At the very least, having the conversation with an outside resource that offers outsourced F&A services, expertise in leading technology platforms and CPA-led service teams is worth the time to find opportunities to achieve these best-in-class benchmarks.

Contact Caroline Jiang at caroline.jiang@cohencpa.com if you are interested in learning more about how outsourcing solutions can be configured for your business.

Cohen & Company is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law.