In this installment of our series on leases, we offer insights into ASC 842’s potential impact on your company’s debt covenants and what you should be doing now.

Private companies and not-for-profits are by now aware they will have to implement ASC 842, Leases, beginning in 2022. Early adoption is permitted, yet a July 2021 survey of a portion of our private company clients showed that approximately 90% have not implemented the new standard. While that’s not surprising, it is also interesting to note that from that same group, roughly 85% have either not begun thinking about, or are in the very early stages of thinking through, the process.

To adequately prepare for the transition to ASC 842, there are numerous steps a company must go through, including, among others:

- Identifying leases within your organization,

- Abstracting and separating key lease information and data,

- The initial and subsequent accounting for the leases, and

- Presenting and disclosing the related financial information.

With the complexities and time commitment of creating and executing an implementation plan, there is one important consideration that may be overlooked, or considered after adoption is complete: Will there be any potential impact on your debt covenants? The answer is, likely, yes.

It is critical for companies to read the details of their debt covenants, determine the impact stemming from the adoption of ASC 842 and begin conversations with their lenders now.

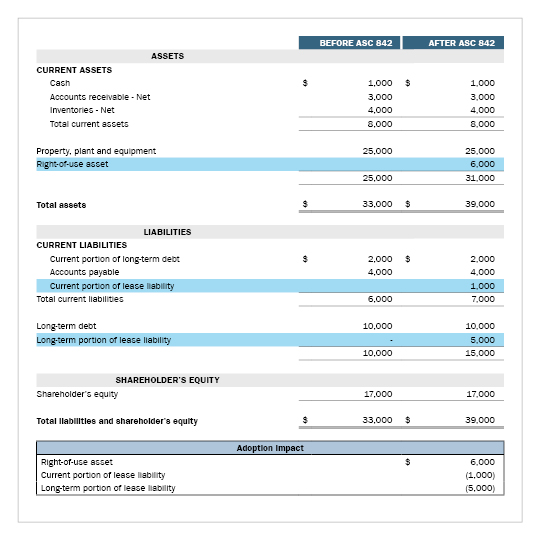

The balance sheet below illustrates the potential impact on some of the most common debt covenants. At the date of adoption, in this example, the company will record a right-of-use asset, which is a noncurrent asset, and a lease liability, which has both current and noncurrent classifications, for one operating lease.

While the balance sheet was created for illustrative purposes, the covenant descriptions were taken directly from common definitions we often see written in debt agreements.

Examples of the impact to four common debt covenants related to this sample balance sheet follow below.

1. Current Ratio

Actual Covenant Description: Borrower shall maintain a ratio of current assets to current liabilities of not less than 1.20 to 1.00, as of the end of each fiscal quarter.

>> Takeaway: If your company is adopting ASC 842 and you currently have long-term operating leases, there will be an adverse effect on your company’s current ratio upon adoption, as you will be recording a noncurrent asset and a current and noncurrent liability.

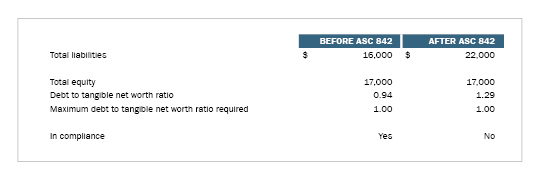

2. Debt to Tangible Net Worth Ratio

Actual Covenant Description: Borrower shall maintain a ratio of debt to tangible net worth of not more than 1.00 to 1.00 as of the end of each fiscal quarter. As used herein, "debt to tangible net worth ratio" means the ratio of the borrower's total liabilities to the borrower's total tangible net worth. As used herein, "tangible net worth" shall mean the borrower's net worth, less all intangible assets, such as goodwill, tradenames, and other similar intangible amounts.

>> Takeaway: It is important to look at the definitions within your debt agreements. Simply looking at the name of this ratio might imply that the input is only debt or loans payable. However, upon review of the definition of the ratio within this debt agreement, debt is defined as the borrower's total liabilities. In situations where debt is defined as total liabilities, there will most likely be an adverse effect upon adoption of ASC 842 if your company currently has long-term operating leases. You will be recording lease liabilities that were not previously recorded on the balance sheet and will increase total liabilities. While there are situations where an adjustment to opening retained earnings will be made, this illustration does not affect equity.

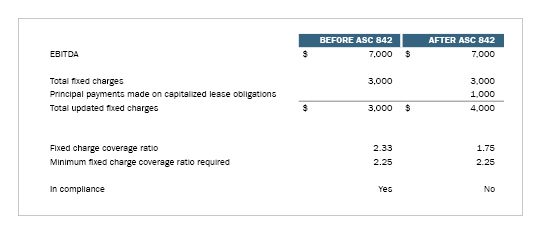

3. Fixed Charge Ratio

Actual Covenant Description: Borrower shall not suffer or permit the fixed charge coverage ratio, for the most recently completed trailing 12 months, to be less than 2.25 to 1.00. Fixed charge coverage ratio shall mean, for any period, as calculated in accordance with GAAP, the ratio of EBITDA to total fixed charges. Total fixed charges shall mean interest expense paid in cash and regular scheduled principal payments on funded indebtedness. Included within the definition of funded indebtedness is capitalized lease obligations.

Takeaway: The above illustration assumes the company's performance is "all else equal" before and after the adoption of ASC 842. The definition of funded indebtedness includes capitalized lease obligations. It is important to note that the difference between capitalized lease obligations, as stated in the definition, and capital lease obligations. Under the new standard, companies are required to capitalize lease obligations that were not previously recorded on the balance sheet. Assuming all else equal, after the first year of adoption, included within fixed charges would be the $1,000 of regularly scheduled principal payments on the capitalized lease obligations. In addition, EBITDA is not a GAAP definition. You will need to consider what is included within the definition of EBITDA per your debt agreement. If you have similar wording written into your debt agreements, you need to know how your lender will treat the scheduled principal payments on the newly recorded lease obligations. If you aren’t sure, it may be time to start having discussions with your lender versus after you adopt the new standard.

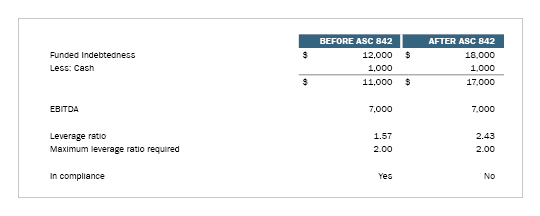

4. Leverage Ratio

Actual Covenant Description: Borrower shall not suffer or permit the leverage ratio, for the most recently completed trailing 12 months, to exceed 2.00 to 1.00. Leverage ratio shall mean the ratio of funded indebtedness, minus cash on hand, to EBITDA. Included within the definition of funded indebtedness is capitalized lease obligations.

Takeaway: Similar to the fixed charge coverage example above, the definition of funded indebtedness includes capitalized lease obligations. If you are unsure how these will be treated within your covenant requirements, it will be important to receive clarity from your lender.

As shown in all the examples above, the adoption of ASC 842 determined whether or not the company was in compliance or in default of their debt covenants. Conversations with your lender will be critical to determine whether you will need adjustments to your current covenants after you adopt ASC 842.

If you have lease agreements in place and you are unsure how your lender will interpret the newly presented financial statements, the communications need to begin now. While your accountant can typically provide clarification when debt terms say, “in accordance with GAAP,” you will need clarification from your lender if there are ambiguous terms within the agreements.

If you are a company that is required to adopt ASC 842, as most are, below are some examples of next steps your management should be taking:

- Read through your current debt terms and covenant requirements.

- Talk with your lender about what they are doing for ASC 842 to determine how they are changing agreements, if at all. It is important to know and understand these effects now, so you can plan and communicate with your lender regarding the potential impact.

- Determine how the standard will impact your current covenant agreements in place, if at all.

- Ask for clarification or covenant term changes now, prior to the adoption of ASC 842.

Contact Brian Fiedler at bfiedler@cohencpa.com or a member of your services team to discuss this topic further.

Cohen & Company is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law.