In this installment of our “M&A Essentials” series — offering a fundamental understanding of the concepts, issues and processes every business owner should be familiar with when considering and conducting the sale of a business — we focus on the main people you’ll encounter and need throughout the sale process.

The sale process is often a culminating event for entrepreneurs, yielding financial rewards for years of hard work and risks taken. Whatever the driving force for the transaction, the sale of a privately held business is an often emotional undertaking that can cause serious disruptions in the enterprise unless it is managed properly. The sale process can impact relationships with suppliers, shareholders, family and employees in positive ways if managed well, or, if not, the process can actually damage the overall value of the business.

A well-managed process can position the company for a continuing legacy under a new ownership structure. Planning and executing in a disciplined manner is the shareholders’ best guarantee the business will be sold to the right buyer, at the best price, and under the most favorable terms and conditions.

The first step to understanding the sale process is understanding the key players involved, namely, buyers and advisors.

Buyers

Buyers typically fall into two general categories: strategic and financial.

Strategic Buyers

These can be either public or private companies that target acquisitions for a strategic purpose, such as gaining market share by purchasing a competitor, managing production inputs by acquiring a supplier, or gaining distribution channels by consolidating a dealer network. Other strategic objectives may include diversifying business lines, acquiring management talent or reducing costs.

The objective of a strategic buyer is to build value by integrating an acquisition with existing operations, executing a joint strategy, while growing revenues and managing costs. From a seller’s perspective, the importance of strategic buyers lies in their ability to pay higher values than other buyers evaluating standalone acquisitions. Strategic buyers typically have a unique value proposition that provides a rationale for an acquisition other acquirers may lack. They also often have greater access to capital at a lower cost. These factors generally translate into an ability to value potential acquisitions higher.

Financial Buyers

Private equity groups constitute the vast majority of financial buyers. Their objective is to make acquisitions that generate returns for their investors, typically pension funds, university endowments, wealthy individuals, banks and other investment firms. Financial buyers acquire companies using a combination of the funds raised from their investors and loans from banks and other capital sources. A positive return on their investment is earned as long as their profits exceed their cost of capital. The objective of a financial buyer is to achieve, on average, their targeted return on equity — historically around 20% but moving toward the high teens.

Given the right price and an appropriate capital structure, financial buyers employ a whole host of strategies to build value. Such strategies include bolstering management teams, improving cost structures, introducing new sales strategies and achieving economies of scale through additional acquisitions. A financial buyer’s objective is to buy at the lowest price possible, grow earnings and eventually sell at the highest possible price once the investment has been held for an optimal period of time, typically three to seven years. When financial buyers exit their investments, they usually focus on selling to a strategic buyer, or if the stock market is healthy and the company is large enough, executing an initial public offering (IPO). However, there is a growing trend for smaller private equity groups to sell their portfolio companies to other private equity groups that focus on larger transactions.

Financial buyers often act as strategic acquirers through one of their portfolio companies — we call them hybrid buyers. A portfolio company owned by a financial buyer may act similar to a strategic buyer even though the capital they employ is that of a financial buyer.

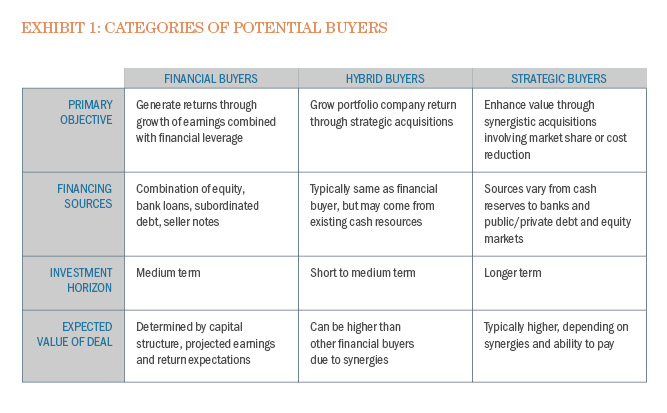

Exhibit 1 below provides a snapshot of the different types of buyers. In M&A transactions, it is important to know the potential buyers and communicate accordingly. A strategic buyer and a financial buyer will look at the same acquisition differently. Knowing their “hot buttons” is something that can be assessed through financial analysis, for example, by studying the potential dilution aspects of a deal for a strategic buyer, or by identifying the key elements affecting the returns for a financial buyer.

Advisors

The seller’s M&A team typically includes key members of the management team in addition to attorneys, accountants and investment bankers. Seamless interaction within the team while executing the deal process is critical to its success.

The seller should never fully delegate control of the deal team; that control should stay with the owner throughout the process. This is often difficult for clients who are successful entrepreneurs in their own right but may be overwhelmed when they venture into the unfamiliar world of M&A. Those who manage the process best exercise executive control and daily involvement, while relying on their team to manage their respective responsibilities within the process and coordinate with the rest of the team.

Attorneys

Most companies contemplating a divestiture or a sale already have a law firm relationship already in place. However, an attorney that deals with the day-to-day aspects of a business may not have the specialized knowledge required for M&A transactions. An experienced deal attorney is essential in any sale. He or she is responsible for ensuring the deal is structured and documented properly. The best attorneys know where pitfalls can occur and how to protect their clients well after the deal is closed. Most law firms either have this expertise in-house or know other firms that can assist.

Accountants

The role of the accounting firm has expanded as the M&A world grows in sophistication. Buyers need to have confidence in the accuracy of the financial statements. Furthermore, the company’s accounting firm is pivotal for due diligence when buyers are conducting their investigations of the business. Companies should plan early for an M&A transaction and establish reliable and accurate procedures and reporting systems. A preemptive due diligence review, known as a Quality of Earnings report or QofE, conducted early in the process is a good investment for any firm contemplating a transaction. “Clean” companies command greater value and can withstand pressures by buyers to lower valuations as the deal proceeds.

Investment Bankers

The third critical leg of the M&A team is the investment banker, who acts as process manager, financial analyst and head marketer. The investment banker must understand the company, its industry and all of the elements that determine the value of the business. Duties of the banker include the preparation of marketing documents, building financial models, developing a target list of potential buyers, contacting interested buyers and conducting the auction that ultimately maximizes the value of the deal for the seller. Good bankers excel at developing the strategy of the deal and adapting the marketing process as it evolves.

Choosing the right deal team is critical. More often than not, the deal team is chosen based on those who have attained a position of trust with the seller or have been selected through a “beauty contest.” Compatibility with other team members is an important trait for any potential team member. Other criteria include:

- Competence (do they know what they’re doing?)

- Market credibility (do they have a good reputation?)

- Proven track record (do they get the job done?)

Many potential sellers weigh industry knowledge heavily. However, this can be a double-edged sword. The team should be loyal to the seller and not the industry.

Any seller recruiting a team should pay as much attention to assembling their team as they have invested in growing the business. The sales process, being disruptive and time-consuming in nature, often only gives a seller one shot at getting the sale done right. Changing the team in the midst of a deal is very difficult and will be perceived poorly by the marketplace.

Part II of the sale process will go in depth about the progression of stages that characterizes most M&A deals.

Contact Jim Lisy or a member of your service team to discuss this topic further.

Cohen & Company is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law with your professional advisers.