Sophisticated organizations often treat acquisitions as an integral part of their enterprise growth strategy, and, as such, take a proactive approach to the pursuit and execution of a transaction. They invest in building capabilities that allow them to efficiently execute transactions and drive value from their acquisition targets — ultimately becoming a value differentiator.

But with an alarmingly high failure rate for mergers and acquisitions (between 70% and 90%, according to a recent Harvard Business Review study), why will companies still spend trillions of dollars this year pursuing acquisitions? The allure of executing an acquisition to help accelerate growth objectives and meet goals that can’t be achieved internally can often be too compelling to resist. But if the statistics are indeed reality, how can business leaders improve their odds of success?

There are many steps in the acquisition process, each contributing to the overall likelihood for success; however, two often overlooked steps are critically important to whether or not an acquisition meets or falls short of expectations. Perhaps not surprisingly, these two steps book-end the entire acquisition process. The first step ensures that an acquisition strategy is not only defined but is aligned to the overall enterprise strategy. The final step will ultimately determine the overall success of the acquisition in terms of capturing projected value.

Stages of the Acquisition Process

Acquisition Strategy

Organizations that spend the time and effort early in the process to clearly define an acquisition strategy, along with clear objectives of where and how value will be achieved, will have a greater chance of delivering value from the transaction. It’s imperative for leadership to align acquisition candidates to the strategic purpose of the deal. Of course, if a strategic purpose hasn’t been narrowly defined and articulately communicated, trying to align potential candidates will be a futile effort.

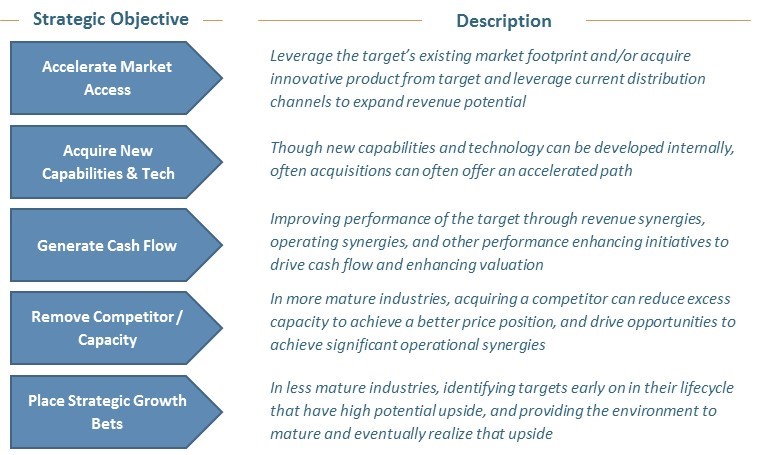

Although there are endless reasons to pursue an acquisition, most acquisitions tend to fall within one of five primary strategies:

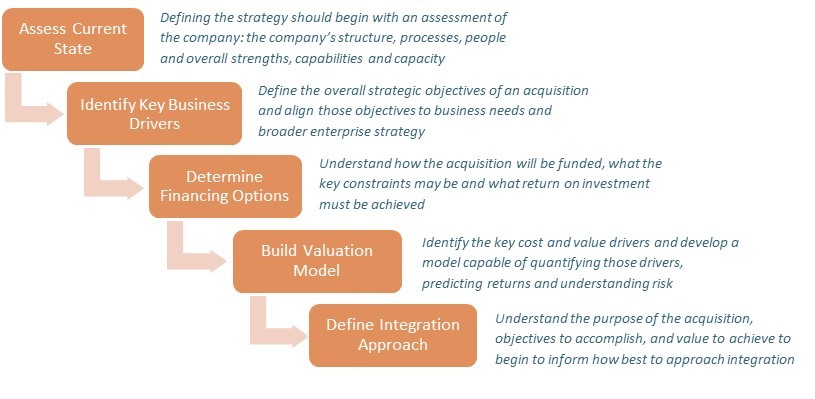

There are five key components to an effective and actionable acquisition strategy. These components build off of each other and begin to form the foundation to establishing a differentiating capability, allowing an organization to be proactive rather than reactive in executing their acquisition approach.

The acquisition strategy essentially answers the “why” — why the company is pursuing an acquisition and why leadership believes the transaction will create value for the organization. Answering the “why” will directly inform “how much” and “how.” The “how much” question refers to how much does the company expect to pay for the acquisition, and how much value does leadership anticipate the acquisition to create. The “how” question answers how will the acquisition be integrated with the existing organization. A well-defined strategy, in a nutshell, will help mitigate the risk of overpaying and ensure the optimal approach to integration is pursued.

Acquisition Integration

Acquisition integration is a process that cannot be taken lightly and cannot be expected to happen accidently or overnight. Figuring out how to best bring together two completely different organizations is a challenge. Add to that the task of extracting desired synergies while minimizing business disruptions and the challenge becomes seemingly herculean.

The two parties need to understand early on in the process how they will function together. Compatibility is not necessarily the hurdle to overcome, but rather, determining how to successfully navigate the incompatibility. This notion is what successful marriages are built upon, and will ultimately determine the overall success of the marriage of two organizations.

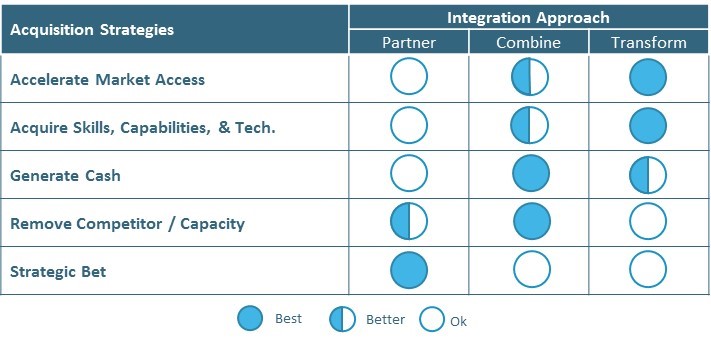

The strategic objectives of the acquisition should almost entirely inform the optimal integration approach. Though there is a spectrum of degrees to which an acquisition can be integrated into the acquiring organization, there are perhaps three primary approaches. Each approach has a distinct set of objectives and outcomes, and each approach can be successful if deployed in the appropriate circumstance and executed effectively.

- Approach 1: Partnering — The acquisition is kept structurally separate and maintains its own identity, culture and organization. Separate management teams, cross-fertilization of strengths, as well as opportunities to learn and grow from each organization will drive growth synergies.

- Approach 2: Combining — The acquisition is efficiently folded into the acquirer, with the primary objectives of minimizing risk and maximizing cost savings related to reducing operational redundancies. Synergies are identified during due diligence are actively pursued.

- Approach 3: Transforming — An approach that looks beyond traditional synergies identified during due diligence, in which a holistic view of both organizations is taken and a transformational approach that looks at people, process and technology prevails to design and build the optimal go-forward business and operating model.

Understanding where and how the acquisition fits in terms of aligning to strategic objectives and how it will create value can help achieve an optimal integration and be a major contributing factor to acquisition success. If the objective is to enhance scale to rigorously drive operating synergies, keeping the acquired organization separate will see a high likelihood of failure. However, if the target is being acquired to capitalize off of its innovative business model, combining entities may be highly disruptive and counterintuitive. Identifying the value drivers early, and ensuring those drivers remain intact and are able to expand, is how value will be realized.

The table below depicts how each integration approach aligns with the different acquisition strategies. While there may be exceptions, this provides a high-level framework for appropriately aligning acquisition strategy to the optimal integration approach.

Looking Ahead

The idea of linking the broader enterprise vision and strategy to a well-defined acquisition strategy, and similarly linking the acquisition strategy to the appropriate integration approach is relatively simple in theory yet can be challenging to successfully execute. And, of course, there are many other issues to consider in bridging the gap from strategy to success, including target research, rigorous due diligence and savvy negotiations. Building the capability and confidence to drive growth and deliver value through acquisitions takes discipline along with an investment in time and resources but can be accomplished with the right advisers and internal commitment.

Contact John Cavalier or a member of your service team to discuss this topic further.

Cohen & Co is not rendering legal, accounting or other professional advice. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts and circumstances with your professional advisers.