Traditionally fund managers have avoided most illiquid investments due to their perceived misalignment with the Investment Company Act of 1940. However, in recent years there has been a convergence in asset classes in search of new investment opportunities. With that, we have seen an increased interest in using real estate investment trusts (REITs) with specific qualified assets in the registered funds industry.

For certain portfolios a REIT structure may offer significant shareholder tax savings as opposed to the traditional mutual fund structure, or regulated investment company (RIC). Those tax savings opportunities come from the Tax Cuts and Jobs Act’s provision allowing noncorporate taxpayers to deduct 20% of their combined qualified business income, commonly known as the Sec. 199A passthrough deduction. The deduction applies for tax years 2018 through 2025, so it presents a limited yet interesting opportunity for fund managers to consider.

Background on REITs vs RICs

The taxation of REITs and RICs is very similar to each other in that if they meet their respective qualification tests, they are allowed a dividends paid deduction and essentially do not have to pay an entity level tax.

REIT and RIC shareholders are also taxed similarly; however, Sec. 199A may create a potential benefit for REIT shareholders when it comes to taxing a certain type of income. Particularly, REITs with a portfolio of mortgage-backed securities (MBS), which would be considered qualifying assets under both the RIC and REIT rules, might see a significant tax savings difference.

Entity Structure and Qualifications of RICs and REITs

RICs

RICs exist to allow small investors to pool their capital and benefit from economies of scale, diversification, professional money management and other advantages that may otherwise only be available to large investors. Among a number of qualification requirements, a RIC must meet the following tests:

- 90% test: At least 90% of the RIC’s income must be derived from dividends, interest, payments with respect to securities loans, and gains from the sale or other disposition of stock or securities or foreign currencies, or other income derived with respect to its business of investing in such stock, securities or currencies.

- 50% test: A RIC must invest at least 50% of its total assets in cash, certain government securities, securities of other RICs and securities of other issuers.

- 25% test: A RIC must invest no more than 25% of its total assets in securities of any one issuer, two or more issuers that the RIC controls that are in similar or related businesses, or one or more publicly traded partnerships.

REITs

A REIT is structured with the goal to provide certain benefits, such as diversification, and at the same time reduce some of the complexities generally associated with direct investing in real estate, such as liquidity and transparency. The REIT legislation, enacted in 1960, modeled REITs after RICs. Similar to RICs, REITs must meet certain requirements to qualify for REIT status and to not pay entity level federal income tax. Among a number of those requirements, a REIT must meet the following tests:

- 75% asset test: A REIT must invest at least 75% of its total assets in real estate assets, certain government securities, cash and cash items.

- 75% income test: It must derive at least 75% of its gross income from real estate–related sources, including rents from real property and interest on mortgages financing real property.

- 95% income test: It must derive at least 95% of its gross income from real estate–related sources or dividends or interest from any sources.

Sec. 199A Tax Savings Opportunity for REITs

The Sec. 199A deduction applies at the individual level rather than the entity level, and qualified REIT dividends are eligible for the deduction. While RIC shareholders can pass through such dividends only if the RIC receives them, a REIT can generate its own qualified dividends. This could potentially yield different results in the taxation of income at the shareholder level.

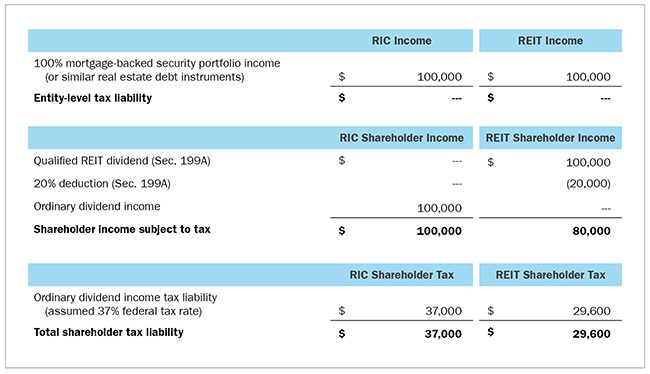

Consider the same portfolio of MBS that qualify as securities under the 50% test for RICs and qualify as real estate assets under the 75% asset test for REITs. Assuming all other requirements are met, the entity could be structured as both a RIC and a REIT. The following example illustrates the outcome to shareholders under each entity structure.

RICs and REITs with no entity-level tax

In the scenario above, there will be no entity level tax, assuming all qualifications are met and the entities make the appropriate distributions to shareholders. All RIC dividends would be reported to the shareholders as ordinary dividend income and taxed at the appropriate rate for each shareholder. The example assumes the highest federal tax rate applies at the individual level. All REIT dividends will be reported to the shareholders as qualified REIT dividends that are subject to the passthrough deduction under Sec. 199A. Therefore, if the portfolio can qualify for both a RIC and a REIT, the REIT shareholders would not have to pay tax on 20% of the income of the REIT, which results in significant tax savings for the REIT shareholders.

There are many tests, compliance requirements, and strategy considerations for RICs and REITs before the application of 20% passthrough deduction tax savings could even be considered. However, assuming all requirements are met and the same portfolio can qualify as a RIC or a REIT, Sec. 199A provides a significant tax advantage to REIT shareholders. Fund managers should consider all tax consequences before deciding on an entity structure.

This article was originally published in the August 2021 issue of The Tax Adviser, an AICPA publication. Read Andreana’s full technical article in The Tax Adviser.

Contact Andreana Shengelya at ashengelya@cohencpa.com or a member of your service team to discuss this topic further.

Cohen & Company is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law.