Contract modifications — any change in the scope or price of a contract — are extremely common in the construction industry and are often seen in the form of claims and change orders. Under the new revenue recognition rules, or ASC 606, Revenue from Contracts with Customers, it’s important to understand how to record such changes.

Specifically, these types of modifications are evaluated under step one (Identifying the Contract) of the five-step process and will require additional judgment and documentation to properly account for them.

Accounting for Contract Modifications

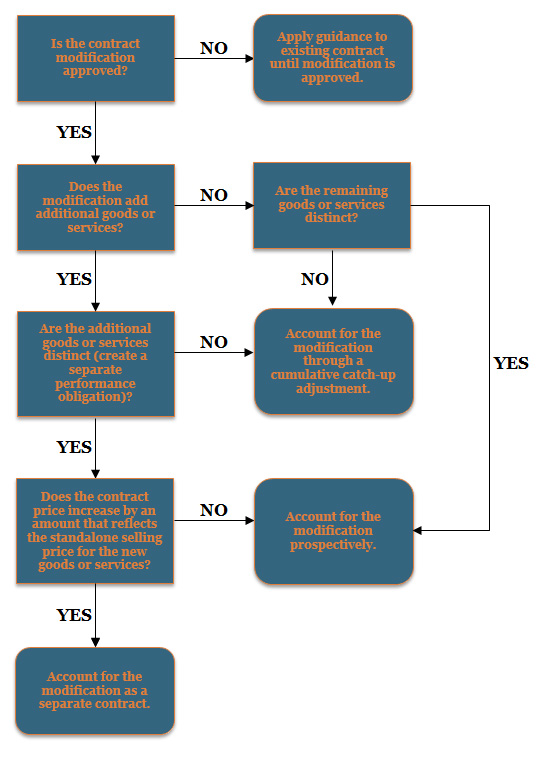

The accounting treatment for contract modifications depends on what was modified. Contract modifications are either treated as separate contracts or modifications of the original contract. The following flow chart summarizes the accounting treatment for contract modifications.

Approval of Contract Modifications

Contract modifications are considered approved when enforceable rights and obligations are created or changed within the contract. The contract modification can be approved in writing, orally or implied by customary business practices. Prior to approval of a contract modification, the guidance under ASC 606 should be applied to the existing contract, until the contract modification is approved.

It is possible for a contract modification to be approved even when there is a dispute about the scope and/or price of the modifications. In determining whether the rights and obligations created or changed by a modification are enforceable, a contractor should consider all relevant facts and circumstances, including the terms of the contract and other evidence.

A common example found in the construction industry is unapproved change orders (scope approved, but not pricing). In this case, the contractor should estimate the change in consideration arising from the modification in accordance with the guidance on variable consideration, which is evaluated under step three (Determine the Transaction Price) of the five-step process. The contractor should estimate the change using historical, current and forecasted information.

Modifications Accounted for as a Separate Contract

Modifications that increase the scope of the contract due to additional, distinct goods or services, i.e., the additional goods or services create a separate performance obligation, and increase the price of the contract by an amount that reflects the standalone selling price for the separate goods or services are accounted for as a new contract.

To determine whether the additional goods or services represent the standalone selling price can require judgment. The standalone selling price should represent a price that the contractor would negotiate independently with the specific customer. ASC 606 notes that, for example, the contractor may adjust the standalone selling price of an additional good or service for a discount that the customer receives, because it is not necessary for the contractor to incur the selling-related costs that it would incur when selling a similar good or service to a new customer.

Modifications Accounted for Prospectively

Modifications that increase the scope of the contract due to additional, distinct goods or services, i.e., the additional goods or services create a separate performance obligation, but do not increase the price of the contract by an amount that reflects the standalone selling price for the separate goods or services are accounted for prospectively, or as the termination of the original contract and the creation of a new contract.

Additional circumstances that would cause a contractor to account for a contract modification prospectively is if the contract contains a single performance obligation that comprises a series of distinct goods or services.

Modifications Accounted for Through a Cumulative Catch-Up Adjustment

Contract modifications that increase the scope of the contract due to additional goods or services that are not distinct from the original, partially satisfied performance obligation is treated as if it were a part of the original contract and accounted for as a cumulative catch-up adjustment.

Contact Nevin Nussbaum at nnussbaum@cohencpa.com or a member of your service team to discuss this topic further.

Cohen & Company is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law.