On Thursday, July 18, 2019, Governor Mike DeWine signed Am. Sub. House Bill 166 into law, which brought to close a longer than expected budgeting process. Below is a summary of the more significant changes that will impact Ohio taxpayers.

1. Individual Income Tax Reductions

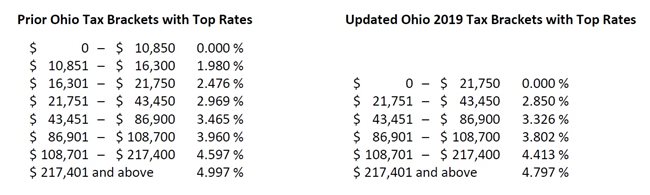

Ohio income tax has been completely eliminated for the lowest two income brackets (or up to $21,750 in taxable income), and all Ohio tax rates were reduced by 4%. A summary of the 2019 tax bracket changes is provided below:

2. Changes to the Business Income Deduction (BID)

Taxpayers operating as C Corporations pay 0% Ohio income tax since the phase-out of the franchise tax. The Ohio BID was originally touted to provide a more favorable tax rate structure for those businesses that also generate significant jobs and investments and operate as pass-through entities versus C Corporations. The BID deduction from Ohio income remains at $250,000, and the 3% flat rate cap on income above the $250,000 is still intact.

However, as a last minute compromise, state legislators and the DeWine administration eliminated the BID for attorneys and lobbyists beginning in 2020. “Eligible Business Income” now excludes income of a business that performs legal services or lobbying activities. ORC 5747.01(B)(2)(a)-(b)

Legal services are defined as “provided by an active attorney admitted to the practice of law in this state, or by an attorney registered for corporate counsel status” in Ohio. Also excluded are executive agency lobbying activities, retirement system lobbying activities and lobbyists whom actively advocate and are required to register with the joint legislative ethics committee.

We expect additional guidance will be issued by the state prior to 2020, as the current language is very concerning. The law, as passed, could be interpreted very broadly and capture traditional businesses that merely employ an in-house licensed attorney or lobbyist, even if these employees do not primarily perform the now excluded activities.

3. Tax Credit Eligibility Changes

Ohio has changed the definition of income used when calculating certain credits. “Modified Adjusted Gross Income” is now defined as Ohio adjusted gross income plus any deduction for BID. ORC 5747.01(JJ)

As such, taxpayers utilizing the following credits must analyze how this change will impact their eligibility:

- $20 personal exemption credit

- Personal exemption deduction

- Joint filing credit

- Ohio dependent care credit

- Retirement income credit

- Credit for persons aged 65 years or older

- Real property tax homestead exemption effective 2020 (2021 for manufactured homes)

4. Additional Tax Credit Changes

- Ohio Opportunity Zone Tax Credit: HB 166 made several modifications to the Ohio Opportunity Zone Credit. Ohio will only allow the credit once the investment is actually invested into the zone property, and Ohio increased the share of fund assets required to be invested from 90% (as with the federal credit) to 100%. Furthermore, Ohio will allow the credits to be transferred one time.

- Motion Picture Tax Credit: This credit was retained, albeit there were several changes made around qualifying projects and companies.

5. Municipal Taxation of Supplemental Executive Retirement Plans (SERPs)

Beginning in 2020, Ohio has added definitions of pensions and retirement benefits plans for municipal taxation purposes. Previously, Ohio did not define pensions which lead to municipalities, attempting to include SERPs in the taxable base. After several taxpayer-favorable court decisions on the matter, House Bill 166 adds further clarity and standardization around the income municipalities may tax. ORC 718.81(YY)-(ZZ)

6. School District Income Tax Base

For school districts that employ “earned income” as their tax base, taxpayers must add back self-employment income and BID when computing taxable income.

7. Wayfair Sales Tax Updates

Like most states, Ohio has updated their bright line nexus standards in light of the 2018 Wayfair decision. Taxpayers with greater than $100,000 of Ohio receipts or 200 separate transactions for the current or preceding calendar year must begin collecting Ohio sales tax effective August 1, 2019. ORC 5747.01 (I)(2)(g)-(h)

Furthermore, Ohio enacted marketplace facilitator rules whereby the facilitator will be treated as the “seller.” As such, marketplace facilitators with Ohio nexus must begin collecting Ohio sales tax effective August 1, 2019. ORC 5747.01 (I)(4)

8. Food Manufacturing Exemption Change

Taxpayers may claim exemption for equipment and supplies used to clean qualifying manufacturing equipment that process “food.” Previously the exemption was limited to processors of “milk, ice, cream, yogurt, cheese and similar dairy products.” ORC 5739.011(B)(13)

9. Repeal of Sales and Use Tax Exemptions on the Following Transactions (Effective October 1, 2019):

- Investment coins/metals (previously stipulated at ORC 5739.02(B)(54)), and

- Professional racing team purchases (previously stipulated at ORC 5739.02(B)(38)).

10. New Vapor Products Tax

Effective October 1, 2019, HB 166 enacts a tax on vapor products and implements the licensing of retail dealers of vapor products. The new tax is $0.10 per milliliter of vapor product.

Effective July 2020, manufacturers and importers of vapor products must also register and begin filing monthly reports with the state.

As mentioned, the Governor has signed the budget so many of these provisions will impact your 2019 tax planning. For specific questions or to learn more about the changes, contact Hannah Prengler, partner-in-charge of our State and Local Taxation Group, at hprengler@cohencpa.com, or a member of your service team. To contact your representative and voice your concerns, visit www.ohiohouse.gov/committee/finance

Cohen & Company is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law.